case study

Problem

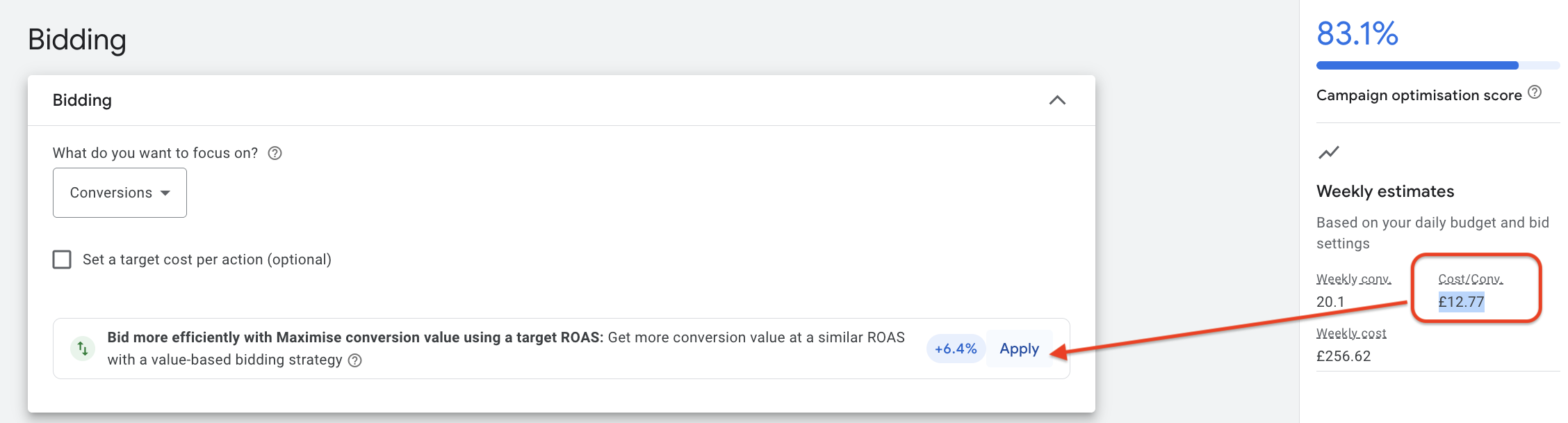

Suggested cost per acquisition (CPA) can be misleading because ad platforms profit when you spend more.

Their target CPA ’recommendations’ are often inflated, based on industry aggregated data, not your actual margins or customer lifetime value. Relying on them without knowing your true CPA can lead to overspend on customer acquisition and lower ROI under the illusion of ‘successful’ campaigns.

Below is a case study showing the ad platform’s suggested CPA of £12.77 is more than double this business’s actual CPA.

Solution

Calculate the true customer acquisition cost (CAC) with the help of your client or their finance team.

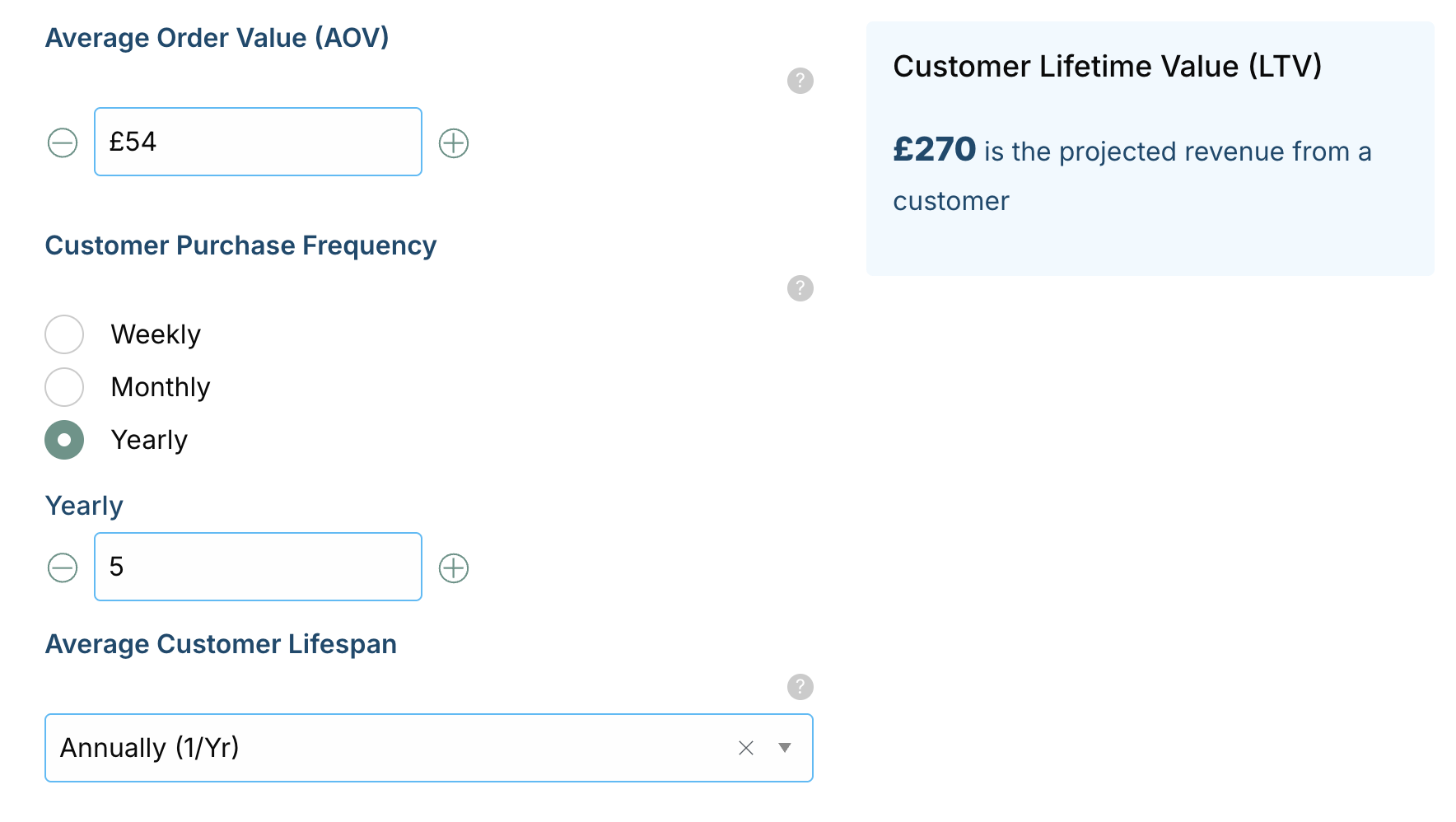

1. Calculate Customer Lifetime Value (LTV)

LTV is an important metric that estimates the total sales a business can expect from a single customer over their lifetime.

In the case study below, the average order value (AOV) was £54 with customers frequently purchasing around 5 times over a single year.

The projected LTV for a single customer was £270.

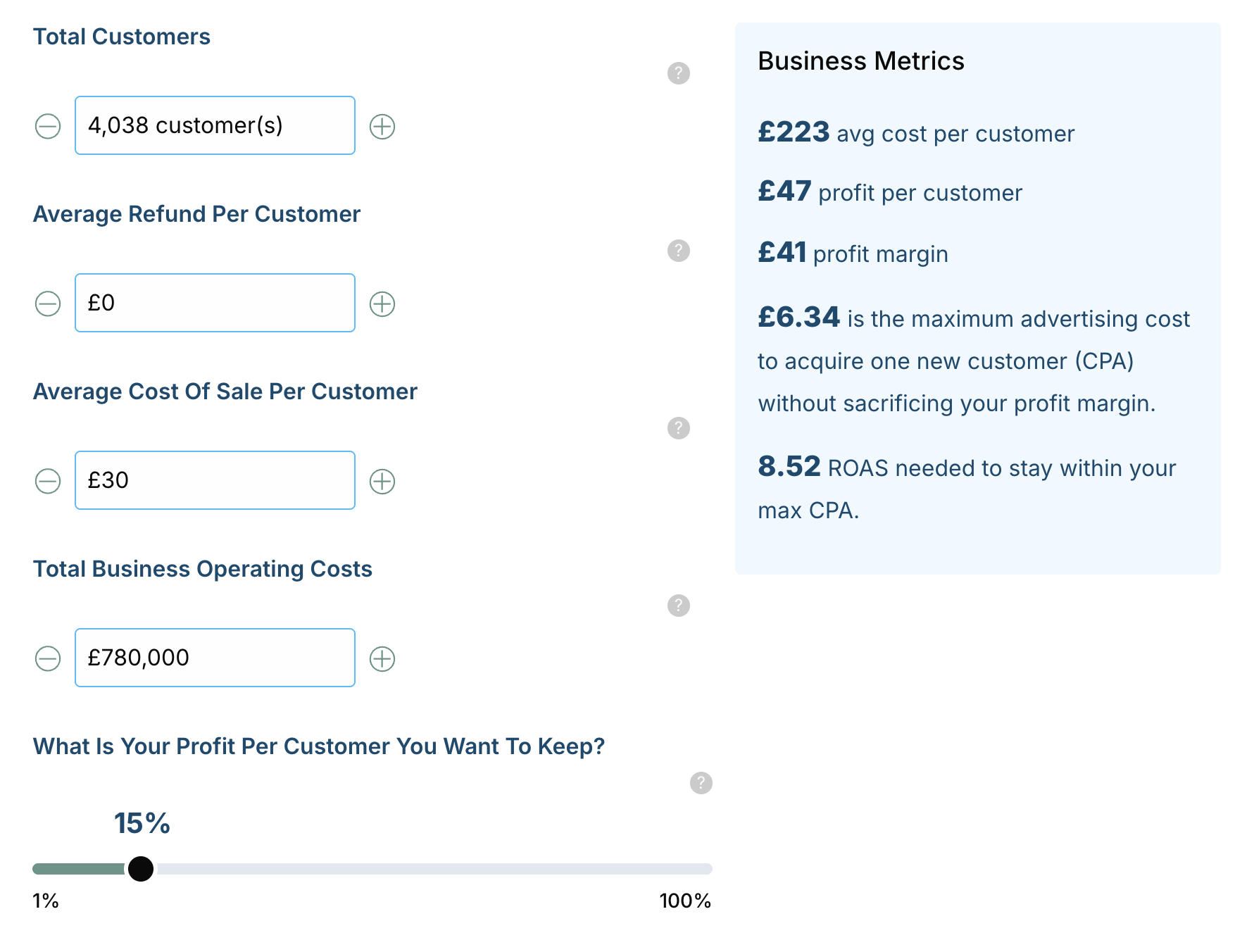

2. Business metrics

There are x2 calculations, one is the operating profit per customer, and the second is the operating profit margin.

2.1 Operating profit per customer

This is the gross income expected from a customer during their lifetime. These include both cost of sale and operating costs with varying business expenses from water, salaries, electricity, rent and refunds (if any).

2.2. Operating profit margin

Operating margin is the percentage of total projected revenue from a customer LTV after deducting all cost of sale and operating costs.

One can see from the image above tha this business has a total operating costs of £780k per year with a cost of £30 per order.

The average cost per customer was £223, with a profit of £47 per customer. The business wants to keep 15% of the customers LTV (£270) and reinvest in marketing, resulting in an operating profit of £41.

This leaves the business with a maximum of £6.34 CPA to acquire a new customer without sacrificing their profit margin.

Advertising campaigns need to maintain a profitable return on ad spend (ROAS) of 8.52 (AOV/Max CPA) or more to stay within the business’s maximum CPA target without impacting the bottom line.

Impact

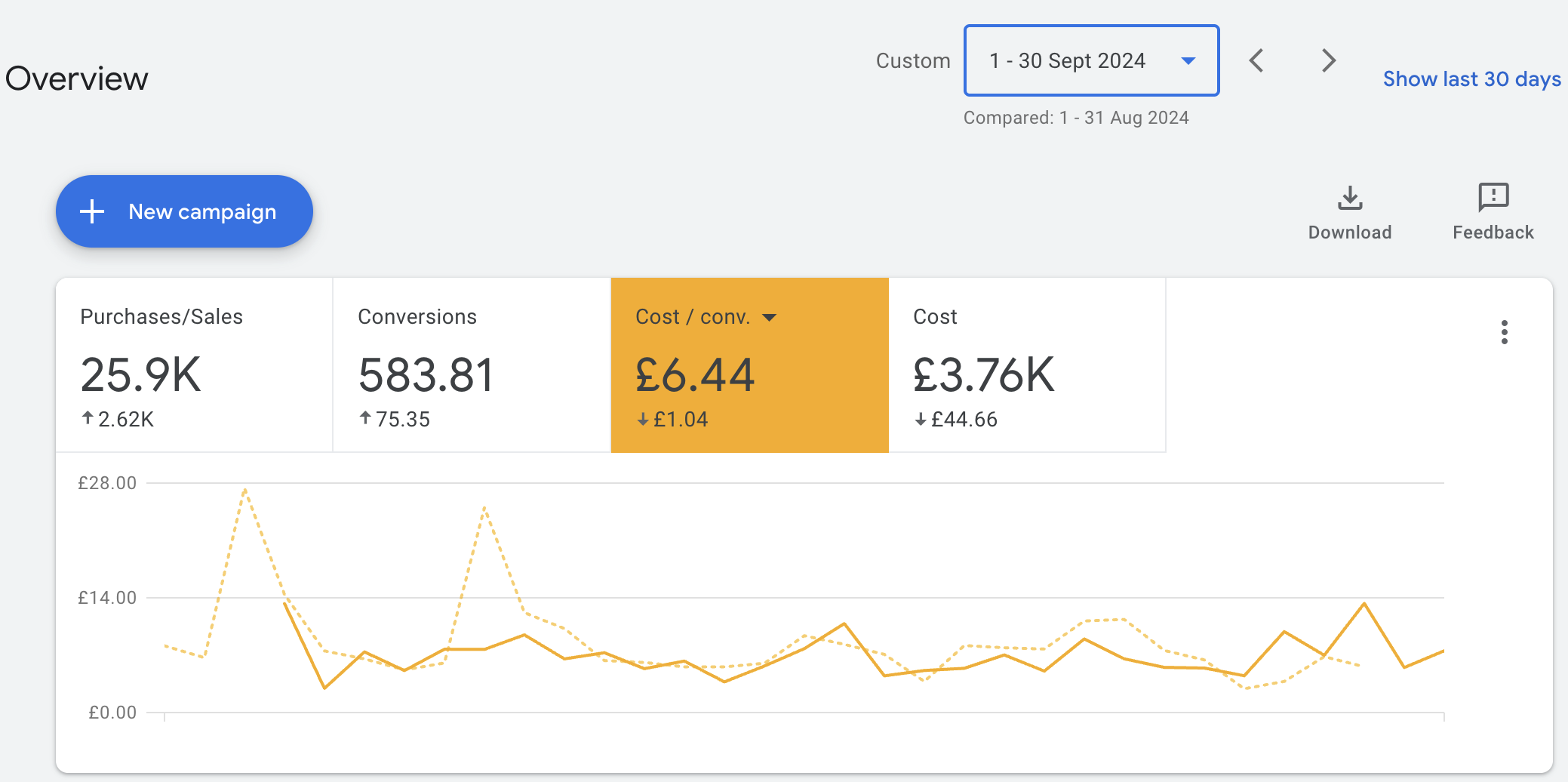

30 Days Later

- Transaction volume increased by 75 orders.

- CPA dropped from £7.48 to £6.44 which is inline with their business operating margin.

- While ad spend decreased by £45, total revenue increased by £2.62K.

Summary

You cannot scale paid advertising effectively without knowing your business’s true CPA.

As shown above, ad platforms often overestimate suggested CPAs, which can fluctuate based on industry and budget. This leads to confusion and contributes to random optimisations that may either improve or diminish returns on marketing invested.